Crypto market maker play a crucial role in ensuring that the crypto markets are operating at a high level. These professionals help maintain liquidity, increase order flow, and provide technical support. Market makers also ensure that tokens are properly priced and available. They ensure that orders are filled instantly. Without the services of a market maker, a market would be less competitive, and users would be unable to access a crypto asset at a price they were willing to pay.

There are several different types of market making firms. Some are centralized, while others are more diffuse. Some specialize in a specific industry, while others are geared towards providing the entire crypto ecosystem with market making services. Regardless of the type of market maker, they all have one thing in common – they make it easier for traders to buy and sell a token.

Most market makers use automated trading algorithms to make trades. This allows them to place thousands of orders per day. It also keeps human involvement to a minimum. However, the infrastructure offered by most crypto exchanges restricts the effectiveness of such strategies.

A well-developed market maker program can ensure that a token is not only listed on a reputable exchange, but is also fully liquid. The presence of a good market maker can attract sophisticated investors, and allow for a wider variety of tokens to be traded. Additionally, a good market maker can facilitate the token’s move to a higher tier exchange. Ultimately, market makers enhance the confidence that tokens have in the long-term.

Some of the leading crypto market making firms are Keyrock, GSR, Kairon Labs, and Wintermute Trading. All of these firms operate worldwide. Their business models and technology are based on the latest concepts in machine learning and AI.

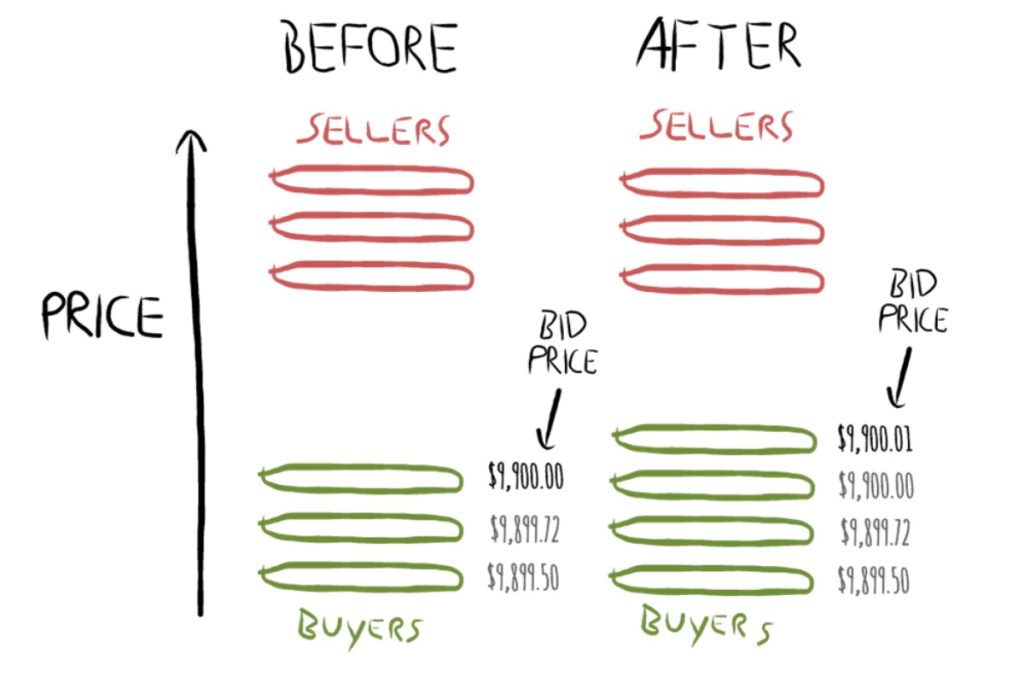

A market maker’s primary job is to create a market that is attractive to both sellers and buyers. Market makers do this by submitting the best bid and asking price of an asset. For this purpose, they will set the bid-ask spread, a difference between the bid and ask price, at the appropriate levels. Once a market maker submits an order, he or she will maintain it for as long as it takes to complete the transaction. In addition to creating a competitive bid-ask spread, market makers actively place orders to maximize their profit.

Market makers can also act as a catalyst for tokens that lack liquidity. Tokens that have a low liquidity can have their prices fluctuate, or even suffer a decline in value. Conversely, an established firm can provide reliable, institutional grade liquidity for a broad range of tokens.

The crypto market is extremely volatile. That is why it is important for tokens to be as liquid as possible. Ideally, they should be available to be bought or sold at any time, without significant change in price. Unfortunately, this can be difficult to achieve for a variety of reasons.

Aside from the liquidity benefits, proper volume can help a token get a better price. In fact, research shows that a token’s long-term stability is affected by the liquidity of its coins.

Review What Is a Crypto Market Maker?.